Here at Smarter Loans we see a lot of loan applications and often there is some gambling that shows up, and so we are often asked how does gambling affect a loan application.

Rather than answering this same question multiple times we thought we should write an article that explains how gambling affects loan applications and what you can do if you enjoy gambling as a hobby, or are addicted to gambling.

How Lenders Treat Gambling

A lot of Kiwis gamble at least a bit.

Lotto is the most common form of gambling and yet people think that it’s okay saying “it’s not really gambling but a bit of fun” – but it is still gambling. It’s deemed to be okay if you spend $20 a week on something like Lotto.

Another common form of gambling for Kiwis is the TAB where you might have a bet on the horses or another sport. Again, most people think this is okay and generally it is accepted by lenders as a bit of entertainment.

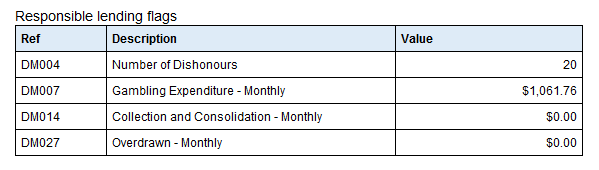

When the lenders review your bank statements they can see the gambling which is notes in the “Responsible Lending Flags” meaning that these are the things that are flagged as something that lenders need to consider when looking at an application.

The lenders are required to be “responsible” under the regulations (the Credit Contracts and Consumer Finance Act) and therefore whenever they see things like gambling they have to review the application more carefully. If there is a little bit of gambling then that’s generally okay, but when the lenders see excessive gambling like the illustration above shows ($1,061.76 monthly) then that does raise a red flag and it would be very hard to convince a letter to provide an approval.

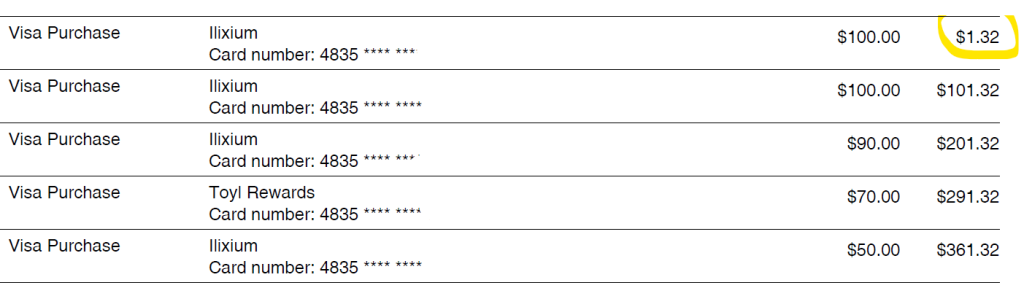

The lenders will also look at the detailed spending on the bank statements and in this case when they see that someone spends all of their money on gambling it is deemed a problem. The example below shows someone that had $361 in their bank account and spent $360 of that in one session gambling. It’s not the dollar value of the gambling that is the issue, but the fact that they kept spending until they had run out of money.

Gambling can be addictive and it’s easy to think that the next bet might be the winner.

Most people that we show their own bank statement summaries to are surprised how much they have been spending too. They knew that they had spent some money on gambling and may even know that they were spending a bit more than they should, but when someone sees how much they have been spending each month it can come as quite a surprise.

How To Fix Your Statements

Lenders will want to view 3-months of bank statements when assessing a loan application and so will see what gambling you have been doing.

You cannot change the past, but you can change the future.

If you were to stop spending money on gambling then the lenders can see this. It would of course be ideal to have 3-months bank statements showing no gambling transactions, but even if you could show that the gambling has stopped for even the last month then the lenders would look at your loan application more favourably.

Let’s Be Smarter

We hope that this article has been helpful and shows you what the lenders see and how they process the applications when their is gambling evident.

The best thing is to know that the lenders cannot approve your loan now, and therefore don’t just keep trying new lenders. They are all required to be responsible lenders and will therefore not be able to approve your loans, and by applying to multiple lenders you are going to affect your credit score too.

Smarter Loans is all about being “smarter” with how we apply for lending, and that should mean that you get a better deal.