Often people just put up with paying their debts, when they could save a considerable amount by doing a debt consolidation with the right finance company.

Recently we had success for a couple who wanted to buy a home, but were told that they could not afford what they wanted.

From the way that the banks assessed things they couldn’t afford the home loan, but by understanding why we were able to come up with a planned approach that meant they could and reduced the bank costs too.

Our Couples Scenario

Our couple approached us as they wanted to get a home loan, but had been told that they could not afford what they needed to buy the type of home that they wanted. They had found a house they wanted to buy and it was going to cost them $660,000

They were frustrated as they thought they earned enough with him on $90,000pa plus part-time work earning another $20,000pa, and she was on just over $40,000pa. They also have a boarder paying $170 per week.

When we looked at their situation it was not the income that was the issue, but the deposit and other debts.

The deposit – they had a combined deposit of about $80,000 in KiwiSaver and qualified for the First Home Grant of $10,000 which gave them $90,000 or about 14%. As they planned to purchase for $660,000 they would be charged a low equity margin of 0.75% with less than 15% deposit, but this reduces to 0.30% (saving $2500 a year / $50 a week) if they could come up with another $9,000.

The other debts – like many young couples they had some debts. They had two credit cards, a store card and a personal loan which came to a total of about $15,000 but the monthly cost for these was $940 and that reduces what money is available to pay the mortgage.

They have to be able to afford those repayments for the debts (credit cards, a store card and a personal loan) as well as the mortgage at the banks test rates and including the low equity margin.

We Needed A Plan

Once we had the information the plan became quite obvious.

- We needed to consolidate the existing debts (credit cards, the store card and the personal loan) and reduce the repayments

- They needed extra money for the deposit so they could get to 15% and therefore reduce the low equity margin that they would otherwise be charged

- Then they needed the mortgage approval

We started by assessing the mortgage on the basis that they had a deposit of $100,000 and reduced debt repayments … and it worked.

Then we arranged a debt consolidation loan to reduce the repayments and with a top-up of $10,000 which could be used toward the deposit.

A Debt Consolidation Loan Helps

We needed to arrange a debt consolidation loan to wrap all their debts into a single loan, with the aim of lower interest rates and reduced repayments.

They had the following loans:

They also had accounts with Laybuy and Afterpay which had nothing owing, but as they have a limit they do affect the loan application. We had them close these accounts and provided this information to the lenders.

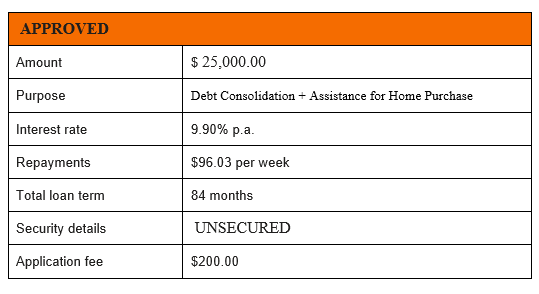

We managed to get a personal loan for this couple.

The personal loan was approved for $25,0000 which included the consolidation of there existing debts and some money available that could be used towards the deposit on the purchase of their home.

This loan was approved at 9.90% which was a lot lower than what they were paying. Even the personal loan with their bank was at 18.95% which is almost double what they are now paying!

But the main thing for this couple was getting the repayments reduced.

Smarter Loans Make A Huge Difference!

It’s great to see how a debt consolidation loan helps a young couple save money, and enable them to buy their first home.

This is how the advice from the team at Smarter Loans can make a huge difference to people.

Of course, the benefit of just consolidating the loans was huge and reduced the interest that they were paying by over half. It also lowered the repayments which helped as they were buying a home, but there is still the ability to increase the repayments which would pay this loan off faster and save them even more.

Getting the extra to help with the deposit also helped and saved another $2,500 per year.

Overall a fantastic result for this couple.

Pingback: Replace Your Expensive Debt Today!

Pingback: You Should Consolidate That Credit Card Debt Today!

Pingback: Start Saving Today With Affordable Debt Consolidation Loans